Crypto Market Sentiment October 27 2025

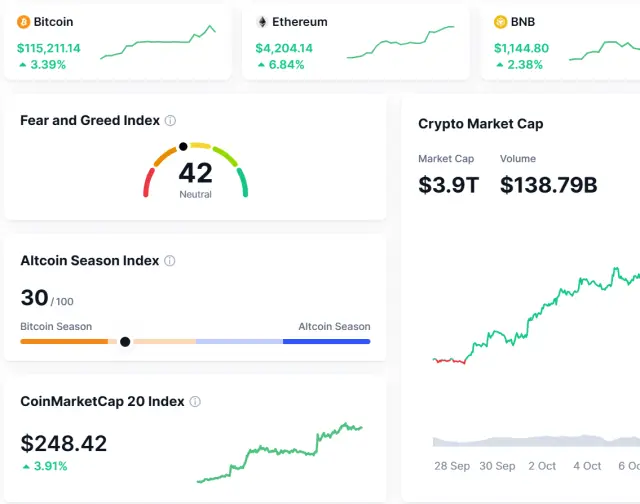

Cryptocurrency sentiment as of late October 2025 remains largely bearish and fearful, reflecting exhaustion and frustration across the market. On social platforms like X (formerly Twitter) and through broader market trackers, traders are expressing uncertainty, thin liquidity concerns, and fading conviction amid price stagnation. The Crypto Fear & Greed Index continues to hover in the “fear” range, typically between 25–40, suggesting caution but also potential buying opportunities for contrarian investors.

1. Market Overview Fear Still Dominates

Despite Bitcoin showing resilience near 107,000, the overall crypto market mood is tense. Market participants are weary of what they describe as endless “chopsolidation”—sideways price action with frequent fakeouts. Altcoins are lagging, liquidity remains thin, and traders are losing patience.

While fear dominates, a few signs of cautious optimism are emerging, particularly as U.S. equities hit new highs and institutional data suggests renewed accumulation in Bitcoin wallets.

Fear & Greed Index Snapshot

| Date | Fear & Greed Score | Interpretation | Source Notes |

|---|---|---|---|

| Oct 20 | 34 | Fear | ETF outflows offset social buzz |

| Oct 21 | 25-29 | Extreme Fear | Cautious investor entry points |

| Oct 22 | 25 | Fear | Altcoins stagnant; stablecoins steady |

| Oct 23 | 27 | Fear | Regulatory concerns weigh on sentiment |

| Oct 24 | 30 | Fear | 70% of traders frustrated with “toxic” action |

| Oct 25 | 37 | Fear | Hint of recovery, altcoins still weak |

| Oct 26 | 36-40 | Fear (Cautious) | BTC dominance rising to 55–59% |

Scores below 50 indicate “fear,” often coinciding with early accumulation phases or market bottoms.

2. Key Sentiment Trends on X (Twitter)

Analyzing roughly 40 high-engagement posts from October 20–27, sentiment splits as follows

- Bearish/Fearful (~65%) – Traders voice exhaustion, calling the market “dead,” “painful,” and “hopeless.” Altcoins are labeled “bleeding” or “a dumpster fire,” with many pleading for a relief rally.

- Neutral/Cautious (~25%) – Some analysts advise patience, interpreting dips as long-term accumulation zones. Bitcoin dominance above 55% is viewed as both stabilizing and suppressive for altcoins.

- Bullish (~10%) – A smaller group remains optimistic, citing strong U.S. equity performance and Bitcoin’s resilience. Mentions of “Q4 recovery” and “institutional inflows” hint at underlying confidence.

Representative Themes from X

- Fear & Exhaustion “Gross” monthly candles and “dreams destroyed” describe the tone among traders.

- Cautious Neutrality Many see this as a “reset phase” before the next leg up.

- Minor Optimism Posts point to Bitcoin’s stability, gold’s stagnation, and meme-coin speculation as sparks of hope.

Bitcoin dominates 80% of social discussion, while altcoins (especially SOL, ADA, and meme tokens) receive mostly negative attention. DeFi and NFT chatter remains subdued but mildly optimistic.

3. Broader Web Context Fear with a Side of Resilience

Outside of social media, market analysis reports the fear sentiment but emphasize it as temporary rather than terminal. After October’s 370B flash correction and Bitcoin’s 10% , analysts describe the situation as a “reset phase” rather than a full bear cycle.

Notable Web Insights

- Sentiment “Neutral to cautiously optimistic” with Fear & Greed rising to 48 midweek.

- Altcoins Still lagging, though accumulation patterns are emerging.

- Institutional Interest Over 190 corporate treasuries now hold BTC, signaling long-term confidence.

- Macro Influence Negative correlation with gold (-0.79) dampens short-term enthusiasm.

While fear dominates, the tone is less panic-driven and more fatigued, often a prelude to trend reversals.

4. Outlook Fear Before the Breakout?

Current sentiment suggests that most retail investors are in “concern mode,” treating rallies as opportunities to exit rather than accumulate. This behavior often precedes recoveries as weak hands capitulate and institutional players accumulate.

Key Takeaways for Traders

- Fear often marks bottoms Historically, high fear levels precede rebounds.

- Watch BTC dominance Sustained levels above 55% may suppress altcoin rallies.

- Liquidity remains thin Expect volatility from cascading liquidations.

- Macro linkage Crypto may mirror equity momentum through Q4 2025.

For long-term holders, this fear-driven environment could be a window of opportunity—provided they manage risk and avoid overexposure. As always, do your own research (DYOR).

5. Conclusion

The crypto community’s current mood can be summed up in one phrase fearful but not broken. The market feels exhausted, yet Bitcoin’s persistence and institutional engagement suggest underlying resilience. With sentiment scraping fear levels and traders capitulating, contrarians may see this as the calm before the next move upward.

While uncertainty remains, history shows that extreme fear rarely lasts—and for patient investors, it often precedes the next wave of opportunity in the cryptocurrency market.

Published on 10/27/2025